Limited loan terms $15 for each prevalence late payment charge Rates an origination fee What to understand

How briskly can I get a loan? You could possibly obtain a loan on a similar working day that you simply apply for it. To acquire a loan swiftly, search for lenders that publicize “fast” or “very same-working day” funding. Specific factors, like what time of day you utilize, irrespective of whether you’re implementing on a company day and Whenever your lender accepts the cash into your account, may possibly have an effect on when you actually get the cash.

Although you can find private loans through standard establishments like banks and credit history unions, on line lenders ordinarily provide the ideal individual loans.

P2P borrowers normally provide loans with extra favorable terms as a result of fairly small threat and low cost for your P2P service companies. P2P support vendors typically function only by an internet site, which is less expensive to operate than a brick-and-mortar financial institution or credit history union. Also, P2P provider providers do not lend specifically, but act instead as middlemen and choose a little cut of all transactions. The lenders bear the loss when borrowers default. Because of this, these P2P provider vendors operate with quite lower chance.

The Section of Training has claimed the Help save program has served more than 8 million financial debt holders as of Might 2024. Whilst the situation functions its way with the authorized procedure, borrowers will be put into desire-no cost forbearance.

So how exactly does LendingTree Get Paid? LendingTree is compensated by providers on This web site which compensation may well effect how and where delivers appear on This web site (including the order). LendingTree isn't going to consist of all lenders, price savings items, or loan solutions obtainable from the Market.

Credit score union emergency loans: Some credit history unions offer you payday loan alternate options. They've relatively lower curiosity prices and you will make use of them to go over crisis charges that pop up. You will find a credit score union in your area at MyCreditUnion.gov.

The speed ordinarily printed by banking companies for conserving accounts, income market accounts, and CDs will be the annual proportion produce, or APY. It is important to comprehend the difference between APR and APY. Borrowers looking for loans can work out the particular desire compensated to lenders dependent on their own marketed fees by utilizing the Fascination Calculator. To learn more about or to try and do calculations involving APR, be sure to take a look at the APR Calculator.

LendingPoint demands you to have a credit score score of at least 660 to qualify for a private loan. In addition, you need to:

Proof of home, including your driver’s license (In case your handle is updated) or possibly a utility bill

Personal debt Financial debt relief Very best debt administration Most effective debt settlement Do you want a personal debt administration prepare? What on earth is credit card debt settlement? Personal debt consolidation vs. debt settlement Ought to you agree your credit card debt or shell out in total? How to barter a personal debt settlement on your own Personal debt assortment Can a debt collector garnish my banking account or my wages? Can charge card corporations garnish your wages?

The calculator takes all these variables into consideration when pinpointing the real annual proportion fee, or APR with the loan. Utilizing this APR for loan comparisons is more than likely to generally be additional specific.

Unlike Biden’s 1st mass college student loan forgiveness prepare, which presented a hard and fast volume of debt reduction to most borrowers, the HEA plan would goal aid to various teams of borrowers. Those who 1st entered repayment at least 20 or twenty five years in the past, borrowers who qualify for loan forgiveness underneath other applications but haven’t utilized, and those that attended schools that misplaced use of federal support because of failure to satisfy regulatory criteria could all receive total college student loan forgiveness beneath the new plan.

Alternatively, lenders use the credit history rating, revenue, debt level, and many other aspects to find out irrespective of whether to grant the non-public loan and at what click here fascination amount. Due to their unsecured character, personalized loans are frequently packaged at reasonably larger fascination fees (as substantial as 25% or even more) to replicate the higher hazard the lender normally takes on.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Judge Reinhold Then & Now!

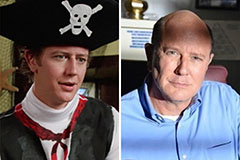

Judge Reinhold Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now!